Unicommerce Share Price: A Deep Dive into Recent Trends

Investors and market analysts have been closely monitoring the Unicommerce share price as it continues to show significant activity in the stock market. Unicommerce, known for its robust e-commerce solutions, has been making waves in the industry, and its stock performance has become a point of interest for many.

About Unicommerce

Unicommerce is a leading SaaS platform that specializes in providing integrated solutions for e-commerce businesses, including order management, warehouse management, and omnichannel operations. Founded in 2012, Unicommerce has quickly become a key player in the e-commerce logistics and operations sector. The company’s platform is designed to streamline and optimize the entire supply chain process, helping businesses manage their inventory, orders, and fulfillment more efficiently.

Unicommerce serves a wide range of clients, from small businesses to large enterprises, across various industries including fashion, electronics, FMCG, and more. Its clientele includes well-known brands such as Myntra, Urban Ladder, and Vero Moda, among others. This broad customer base and strong industry reputation have contributed significantly to the stability and growth of the Unicommerce share price.

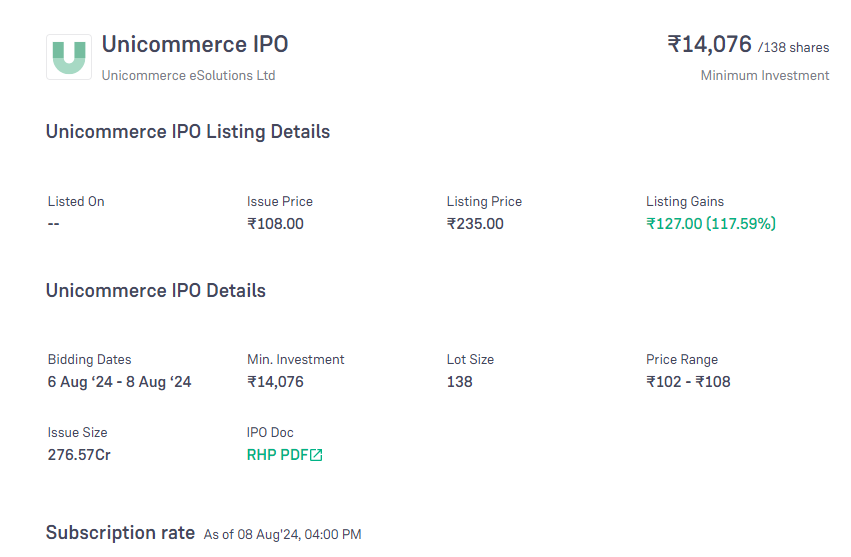

Recent Performance of Unicommerce Share Price

Over the past few months, the Unicommerce share price has experienced fluctuations, which are not uncommon in the tech and e-commerce sectors. Market conditions, investor sentiment, and company announcements have all played a role in these variations. For instance, any new product launches or partnerships by Unicommerce often lead to a surge in the Unicommerce share price.

However, it’s important to note that the Unicommerce share price is also influenced by broader market trends. Global economic conditions, changes in consumer behavior, and competitive pressures can all impact how the stock performs. Investors are advised to keep a close watch on these factors when analyzing the Unicommerce share price.

What Investors Should Watch For

As with any stock, there are several key indicators that investors should monitor to better understand the Unicommerce share price movement. These include the company’s quarterly earnings reports, updates on customer acquisition, and any changes in the management team. Additionally, external factors such as government regulations on e-commerce and technological advancements can also affect the Unicommerce share price.

Moreover, market analysts often provide projections and price targets for the Unicommerce share price based on their assessments of the company’s future growth potential. These projections can serve as a valuable tool for investors looking to make informed decisions.

Conclusion

The Unicommerce share price is a dynamic and influential metric that reflects the company’s ongoing performance and market standing. Whether you’re a seasoned investor or new to the stock market, keeping an eye on the Unicommerce share price is essential for making strategic investment decisions. As Unicommerce continues to innovate and grow, the Unicommerce share price will likely remain a focal point for those interested in the e-commerce sector.

Post Comment